There is transformational change happening in the retail industry as the tension between e-commerce and bricks-and-mortar becomes more pronounced than ever.

The new chapter of retail has four underlying themes driving change, according to the new Future of Retail report from advertising agency, TBWA\Sydney.

Renata Yannoulis, TBWA\Sydney strategic planner and Backslash spotter, explains the key trends and how brands can leverage these to evolve with the market.

- Flex Retail

“Our new relationship with physical space is demanding brick-and-mortar retailers serve a purpose beyond just shopping. Australians are well-versed in the sustainability conversation, driving a new expectation in responsible retailing and mixed-use space to better serve the community. The stores of the future will take a civic role in people’s lives, contributing to cross-sector efforts that revitalise cities, uplift local communities and promote circularity,” Yannoulis says.

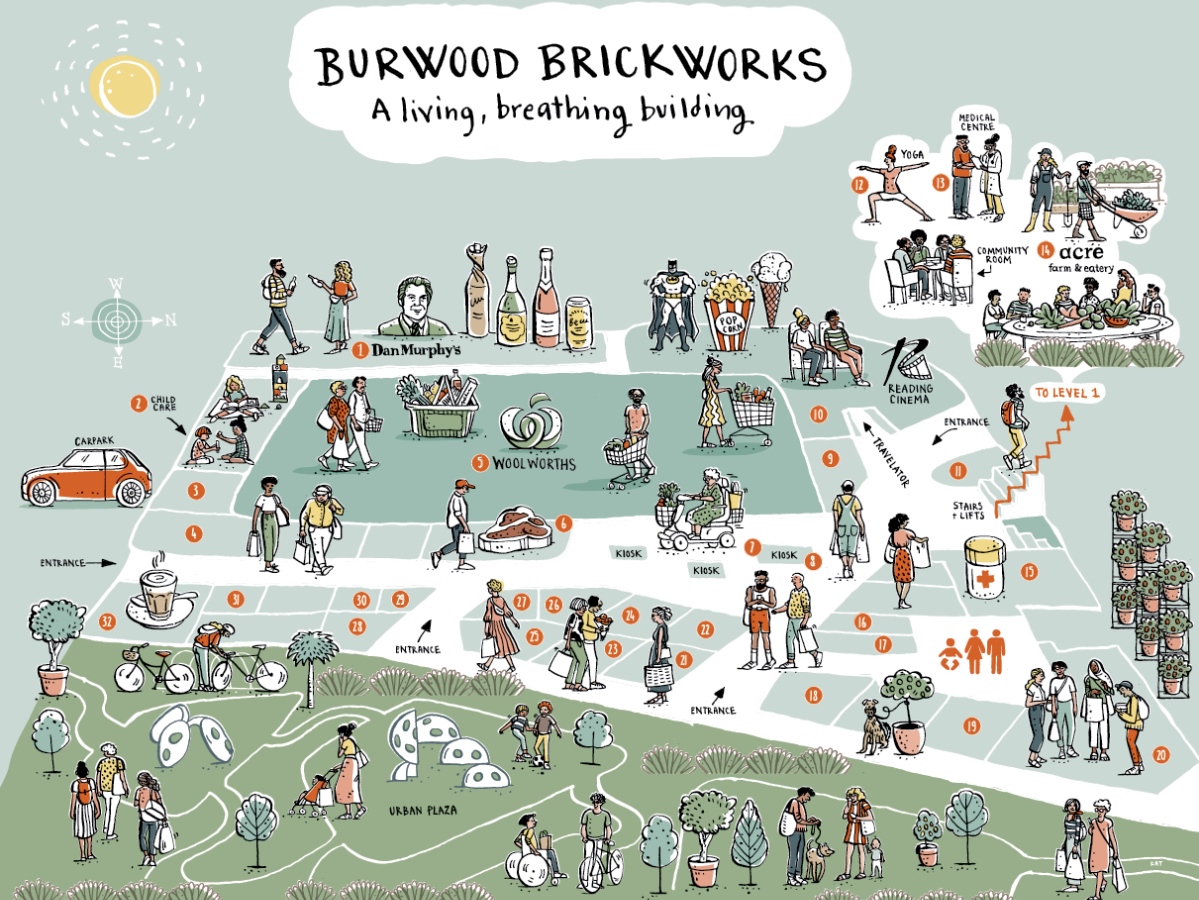

Her examples include Melbourne’s Burwood Brickworks shopping centre’s promise to be the world’s most sustainable and green shopping centre, undertaking one of the largest urban agricultural projects in Australia which includes a 2,000 square metre rooftop farm. In relation to circularity, David Jones’ commitment to stock, support and celebrate more Indigenous First Nations fashion designers, and ‘bring-back’ schemes across the beauty space from small-shops such as Folie to larger-scale practices adopted at Aesop and Lush.

2. Retail’s tech tightrope

“Next-generation retail technology will work behind the scenes to enable a seamless shopping experience rather than add friction into the path to purchase. Companies can choose a more meaningful way forward through phantom tech, intelligent ordering and sensory stores,” Yannoulis says.

“The need for utility, theatre and play in-store has already pushed many brands to reimagine their regular retailing approach into concept store territory.”

Her example was Rebel Sport reimagining floor space to include recreational and online gaming areas to help evoke emotions associated with competitive sport, in-store.

3. Networked commerce

“Driven by a more collective consciousness and rising anti-big brand sentiment, peer-to-peer marketplaces are thriving in Australia. To survive this trend of increasingly communal commerce, Australian retailers must make everyone in their network an active player. Retailers can strengthen relationships by engaging in direct dialogue, pivoting from influencers to educators, and democratising the way in which their business operates,” Yannoulis says.

She referred to The Iconic’s affiliate program, which has opened up its commissions to grassroots consumers, affording mainstream consumers the same perks as well-established bloggers. In addition, Witchery’s partnership with GlamCorner to help reduce textile waste while expanding into the rental economy.

4. Lifecycle luxury

“Premium brands in Australia with affluent, high-disposable income customers are having to contend with a higher expectation in terms of quality, provenance and responsibility. A richer kind of luxury is putting product life cycles and production processes in centre focus. Looking forward, upscale eco-materials, authenticity trackers and functionality will define the new premium,” Yannoulis says.

Some examples include M.J. Bale’s innovation around seaweed inclusion in their sheep-feed to reduce methane emissions of their wool production (similar to Burger King’s inclusion of Lemongrass into beef-feed). Likewise, regeneration is key to KitX’s approach to offsetting carbon emissions associated with online delivery services, committing to plant a tree for every third mailing list sign-up (much like the airline industry).