As more beauty and health brands partner with major online platforms, the future looks dazzling for e-commerce giants such as Alibaba, Amazon and JD.com.

According to Retail Insight, the research and data arm of Edge by Ascential, the world’s leading e-commerce provider, the online share of the global beauty and health market is set to surge to 16.5 per cent post-COVID-19 crisis, soaring to 23.3 per cent by 2025.

Retail Insight reveals that the health and beauty categories will experience the second fastest e-commerce growth after household and pet care over the next five years.

Analysts predict that Alibaba, the Chinese online titan, will gain the biggest global share of e-commerce beauty revenues with US$43 billion in annual sales, followed by Amazon with an estimated US$28 billion.

Both companies have invested heavily in attracting beauty and health brands.

According to Florence Wright, senior retail analyst at Edge by Ascential, Alibaba’s sheer size and scale – set to serve two billion customers globally by 2036 – made it a must-win platform for brands trying to grow their international reach and visibility.

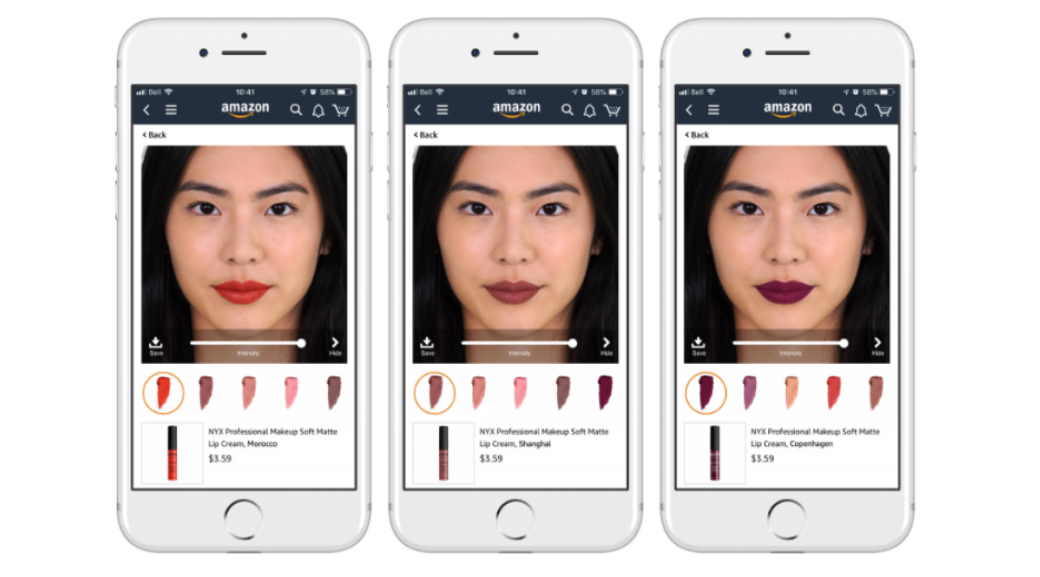

Amazon recently launched its own private label beauty range and expanded an augmented reality partnership with L’Oréal. The US giant should also be an important part of online strategies for brands keen to expand in the EMEA (Europe, Middle East and Africa) region, says Wright.

Amazon’s sales in the EMEA market reached US$99.6 billion in the past 12 months – over three times the size of its nearest online competitor.

In Retail Insight’s view, Amazon is only getting started in the beauty space despite its already-large sales. Beauty brands with ambitions in e-commerce should be monitoring and considering Amazon as a key route to market.

Walgreens Boots Alliance remains the leading global health and beauty retailer in 2020, reports Retail Insight. Total store-based and online sales are expected to reach US$130.5 billion by year’s end – up from US$124 billion in 2019.