Retail Beauty recently reported that L’Oréal was poised to acquire cult Swedish fragrance brand Byredo. But it wasn’t the only major contender waiting in the wings and other industry observers noted that Puig and Estée Lauder also had their eyes on the luxury perfume prize.

Puig has won the race and the Spanish maker of Carolina Herrera, Nina Ricci, Paco Rabanne and Jean Paul Gaultier fragrances, has acquired a majority stake in Byredo.

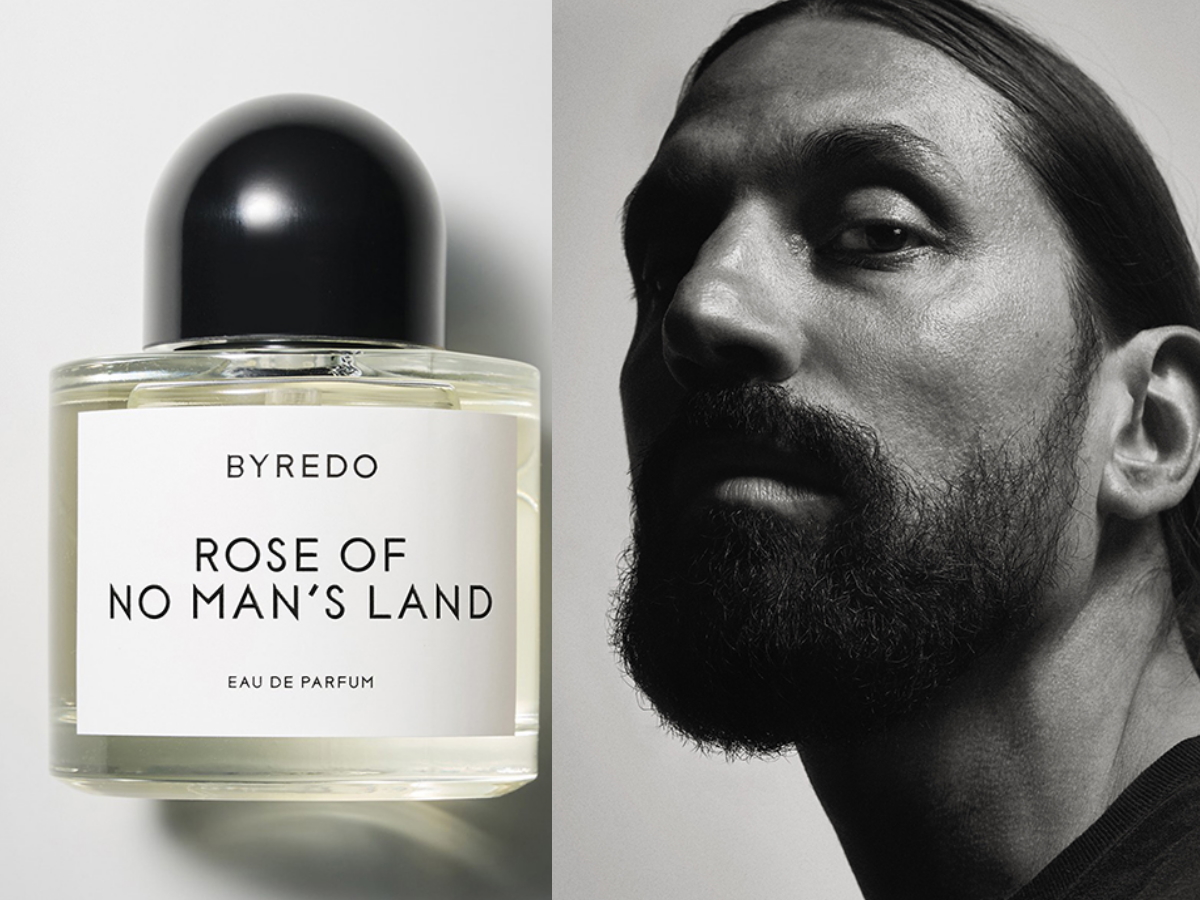

Founder Ben Gorham and Manzanita Capital, the private equity firm which bought a majority share in 2013, will remain shareholders. Gorham also retains his position as Chief Creative Officer.

Puig has been very active in the niche fragrance sector over the past six years. The Barcelona-based company bought Penhaligon’s and L’Artisan Parfumeur, two stalwarts of the genre, in 2015. A year later, it also acquired a minority stake in EB Florals, the scent brand of celebrity US florist Eric Buterbaugh.

The company’s most recent significant buy was a majority stake in Charlotte Tilbury‘s makeup and skincare empire in 2020. Puig also beefed up its beauty chops with a long-term licensing agreement with shoe king Christian Louboutin in 2018. Byredo has ambitions in the luxury makeup sector as well and recently extended into colour cosmetics.

Financial details of the Byredo deal have not been disclosed, but the brand will expand Puig’s footprint in the luxury sector. Currently sold in 55 countries, including Australia, Byredo’s strong ethical stance also enhances Puig’s global consumer appeal.

We are thrilled to welcome Byredo, as it perfectly enforces Puig’s purpose of empowering people’s self-expression, and a strong and conscious commitment to the ESG agenda, noted Marc Puig, Chairman and CEO of Puig.

“Puig will contribute our expertise and resources to the development of this unique brand, which represents modern luxury with a strong consumer connection. This new acquisition marks a key milestone in Puig’s ambition to develop a business with a strong portfolio of purpose-driven brands.”

Puig suffered major setbacks in 2018 and 2019 when it lost the lucrative licenses to make Prada and Valentino fragrances to L’Oréal and has been re-grouping through new agreements and buyouts. In 2021, the company reported global sales of 2.8 billion euros (AU$3.77 billion) and is on track to fulfill its long-term plan to reach 3 billion euros (AU$4.28 billion) in annual revenues by the end of this year.

Read the current issue of our digital magazine below:

- For more news and updates, subscribe to our weekly newsletter

- Follow us on Instagram

- Like us on Facebook

- Connect with us on LinkedIn

- Subscribe to our print magazine