Australian fintech, Slyp, has confirmed national partnerships with several leading retailers, following its already successful rollout at Chemist Warehouse.

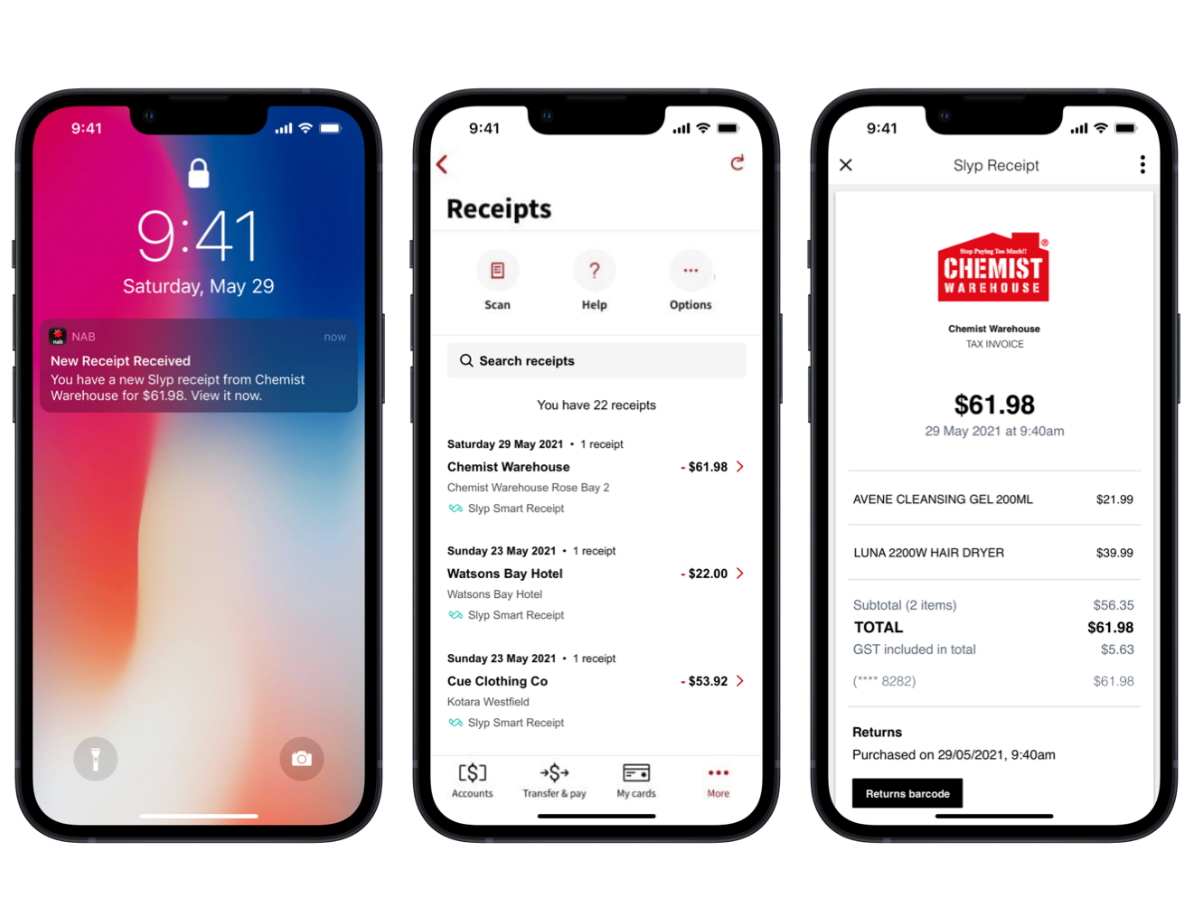

The partnership will see the retailers switch off paper receipt printing – unless requested – for in-store purchases. Instead, Slyp smart receipts will be available to customers instantly via their banking app.

NAB is the first bank to deploy the feature with other major banks also in the process of integrating Slyp technology. For the meantime, non-NAB cardholders can receive the smart receipts via SMS.

The roll-out is powered by one of Slyp’s many point-of-sale integrations with Apparel21, enabling merchants to seamlessly switch on Slyp smart receipts to deliver a smarter, greener proof of purchase.

With further retail partnerships and additional bank integrations in the works, Slyp is planning to be in the hands of one in two Australians within the next 12 months. In doing so, Slyp could become the single biggest customer network in Australia.

“We’re on a mission to eradicate paper receipts at the point-of-sale and make sure that all Australians have access to the smart receipt experience,” Slyp CEO and co-founder, Paul Weingarth, said.

“First, we saw single-use plastics go, and with the recent pledge by 100 countries to end and reverse deforestation by 2030, it’s time to do away with paper receipts.

“Bricks-and-mortar retailers are emerging from what has been another incredibly tough year. Contactless has become the ‘new normal’ and customers are seeking retail environments that continue to keep them safe. By partnering with Slyp retailers can eliminate contact from the transaction experience while limiting the production of unnecessary paper waste.”

This article was first published on RetailBiz.